What a Failed Payment Transfer Actually Means

Not every time when a transfer fails, the money is lost. In the majority of cases, it indicates that the transaction failed to accomplish one of the stages that are necessary for the transfer of funds from one account to another. Imagine it as a relay race where the baton did not reach the next runner.

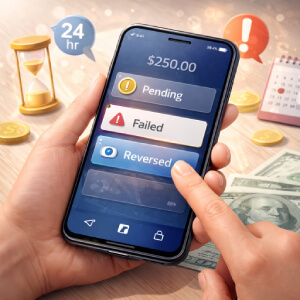

In some instances, the transfer is rejected straight away. In other situations, it remains in limbo for hours or days before being reversed. The system could identify something as unusual, or the bank might decide to put the processing on hold. For the user, all these scenarios are indistinguishable. A rotating icon and no money being where it is expected to be are the only signs.

Common Reasons Transfers Break Down

Bank Processing Limits and Cutoff Times

One could say that banks stick to their old-fashioned schedules. Money transfers that are initiated after hours, on weekends or during holidays, usually have to wait until the next business window to be processed. A payment sent on Sunday night can be held back until Tuesday morning if Monday is a public holiday.

Insufficient or Unavailable Funds

Even if an account shows a balance, not all funds are always available. Pending card charges or recent deposits can cause a transfer to fail quietly. This happens a lot with accounts that receive refunds or cash deposits shortly before a transfer is attempted.

Security Flags and Risk Checks

Payment systems watch for behavior that looks off. New devices, unfamiliar locations, or sudden changes in transfer amounts can all trigger a review. Someone sending money from New Jersey on Friday and Arizona on Saturday might hit a temporary block without realizing why.

Incorrect Recipient Details

A single wrong digit in an account number or routing field can stop a transfer cold. Some systems catch these errors instantly. Others allow the transfer to start and then reverse it later, which feels worse.

Temporary System Issues

Outages happen more often than companies like to admit. During peak usage windows, especially around major sporting events or holidays, systems can slow down or reject transfers altogether.

Here is a quick snapshot of frequent failure causes and what they usually lead to:

- Issue Type - Typical Result

- After-hours transfer - Pending status

- Security review - Temporary hold

- Wrong details - Reversed payment

- System outage - Failed transaction

- Low available balance - Immediate rejection

What to Do When a Transfer Fails

The initial reaction is to panic. That almost never helps. The first thing you should do is look into the payment interface and see the transaction status. Terms such as pending, failed, or reversed carry more meaning than they appear.

When a transfer does not go through at all, the money usually comes back on its own within a few hours or by the next working day. Transfers that are in process generally require patience. Sometimes, if you cancel and retry too soon, it can result in more checks being triggered, which may lead to a worse situation.

A few practical steps tend to help:

- Wait at least 24 hours before escalating, unless funds are clearly missing

- Review recent transactions for holds or pending charges

- Confirm recipient information carefully before retrying

- Avoid sending the same transfer multiple times in a short window

If support needs to get involved, having timestamps, amounts, and reference numbers ready speeds things up. Some might argue support should already have that data, but reality says otherwise.

Refunds After a Failed Transfer

Refunds are the moment when a person's patience is truly put to the test. In case of a transfer failure, the system must frequently reverse multiple processes. First, the money might be taken from one account without the error being recognized, and then come back through the same way. Different refund timelines exist. Transfers linked to cards are usually longer than those through banks. Every weekend is a delay for the transaction. A refund that is marked as done on Tuesday could still be waiting to reflect in the balance till Thursday or Friday.

Understanding Disputes and When to Use Them

Conflicts arise in cases in which the money is not returned as anticipated. They are not suggested for triggering. If you file too early, the refund process might actually be paused.

A dispute usually is reasonable when a transaction is marked as done, yet the receiver did not get the money, or when a refund time has obviously lapsed. Most systems require a brief rationale and back-up information. Visual evidence is useful. Even more so, the evidence of time.

When a dispute is opened, it may take days or even weeks for the resolution. It may be annoying, but it is still a better choice than allowing the problem to get lost.